What is a Real Estate Property? What is your market and what products do you offer? How does it vary and what does it vary the value of it? What leads to the commercial success of a real estate? How important is real estate in the management, economics and finance of companies?

The Market Valuere presents"the estimated transaction amount of a property, at the valuation reference date, between a free buyer and a free seller, under the same circumstances, after

proper marketing of the property, where both parties act knowingly, prudence and without pressure".

We have specialized teams with in-depth knowledge on Real Estate Appraisal that allow us to approach an increasingly changing, diversified, complex and demanding real estate market.

The valuation of real estate property aims to rigorously and reasonably determine the value of a property.

The need for such a property valuation may be of interest for reasons as different as:

- Property transfer;

- Financing and credit;

- Buy and sell;

- Fair compensation in case of expropriation;

- Economic and financial studies of investment projects;

- Cadastral registration as basis for taxes, definition of insurance premiums;

- Fair value of lease, among others.

- In order to evaluate your real estate assets, our objective is to develop for each client a specific valuation, in order to make you totally satisfied.

- Evaluation of lots of land for the construction of houses;

- Evaluation of residential buildings;

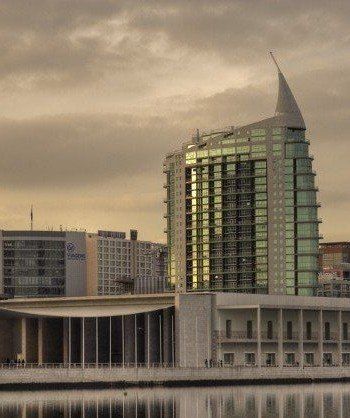

- Office building evaluation;

- Evaluation of shopping centers and retail parks;

- Evaluation of hotels and tourism projects;

- Evaluation of urban land;

- Evaluation of farms and estates;

- Evaluation of agricultural properties;

- Evaluation of apartments and houses;

- Evaluation of manufacturing plants;

- Evaluation of warehouses.

EVALUATION PROCESS:

* Identification of the situation:

- Identification of property

- Identification of rights

- Purpose of the evaluation

- Evaluation date

- Value setting

* Property inspection and market analysis:

- Elements of work

- Physical inspection

- Market analysis

* Application of the methodology:

* Reconciliation and conclusion of values

- Comparison of values obtained:

- Market method

- Cost method

- Income method

- Sensitivity analysis

- Conclusion of value

* Production of evaluation report.

See our property in: www.imoyesok.pt